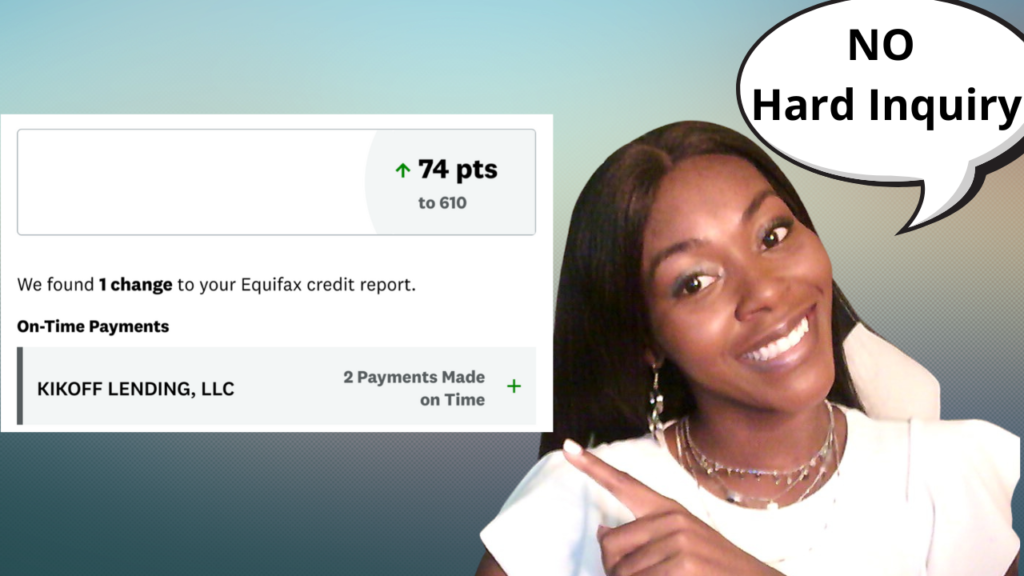

Hey, Beautiful People! Some have seen credit increases over 70 points in as little as one month. Apply today!

Annual Fee

The annual fee for this credit card is $60. You will be charged $5 per day to have this account.

Credit Limit

Credit limit approval will be $750. Your credit limit will be based on how much you deposit in your account.

NO Hard Inquiry

NO Hard inquiry!

Build Credit Faster

Build your credit faster with 2 accounts reporting to the Credit Bureaus.

kikoff credit builder loan

Kikoff credit builder loan in a secured loan that reports to all 3 credit bureaus. You are required to pay $10 per month for 12 months. After your 12 monthly payments, Kikoff will refund $120 to you.

is kikoff worth it?

kikoff credit account is very much worth it. They can approve you even with bad or no credit. They will report to all 3 credit bureaus which should boost your credit scores and allow you to get approved for more credit cards.

kikoff products

kikoff inc offer e-books about finance and fitness and they only cost between $10-$20. You can use you $500 Kikoff credit to purchase your e- book. You monthly pay will be as little as $2 per month.

SIMILAR CREDIT CARDS

FAQ

Most frequent questions and answers

Yes! You can purchase a yearly membership and digital download that they have available in their Kikoff store.

No. Kikoff is not a credit card. It’s an online revolving account that reports to the credit bureaus. You will not receive a card in the mail.

One question that is often asked is how does kikoff work? Kikoff credit is a credit builder that allows users to improve their credit score. It does this by reporting the user’s payment history to the credit bureaus. Kikoff credit also offers a credit monitoring service, which alerts users of changes in their credit score. Finally, Kikoff credit provides a credit counseling service, which helps users understand and improve their credit score. By providing these services, Kikoff credit helps users improve their credit score and become more financially responsible.

Kikoff reports to all 3 credit bureaus.

75 Broadway Suite 226

San Francisco, California, 94111,

United States

kikoff competitors is Self Inc.

Check out other credit cards

*Some of the links and other products are from companies for which Rickita will earn an affiliate commission or referral bonus. Rickita is part of an affiliate network and receives compensation for sending traffic to partner sites. The content in videos is accurate as of the posting date. Some of the offers mentioned may no longer be available.

Disclaimer: Rickita strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider, or specific product’s site. All financial products, shopping products, and services are presented without warranty. When evaluating offers, please review the financial institution’s Terms and Conditions. Pre-qualified offers are not binding. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly.

Kikoff is very much worth it. They can approve you even with bad or no credit. They will report to all 3 credit bureaus which should boost your credit scores and allow you to get approved for more credit cards.